- Chasing Liberty

- Posts

- Schwarber Gets to 50, Jalen Carter Avoids Suspension

Schwarber Gets to 50, Jalen Carter Avoids Suspension

Phillies destroy New York as Schwarber notches his 50th home run

Schwarber Belts 50th as Phillies Crush Mets

Every Morning. Straight To Your Inbox.

Welcome to The Chase, an email newsletter powered by The Liberty Line. Every morning, you’ll get a rundown of all the latest Philly Sports news and other trending topics from across the internet.

Trending Right Now

Stay Connected

Pick Your Poison | Get Right In The Shop |

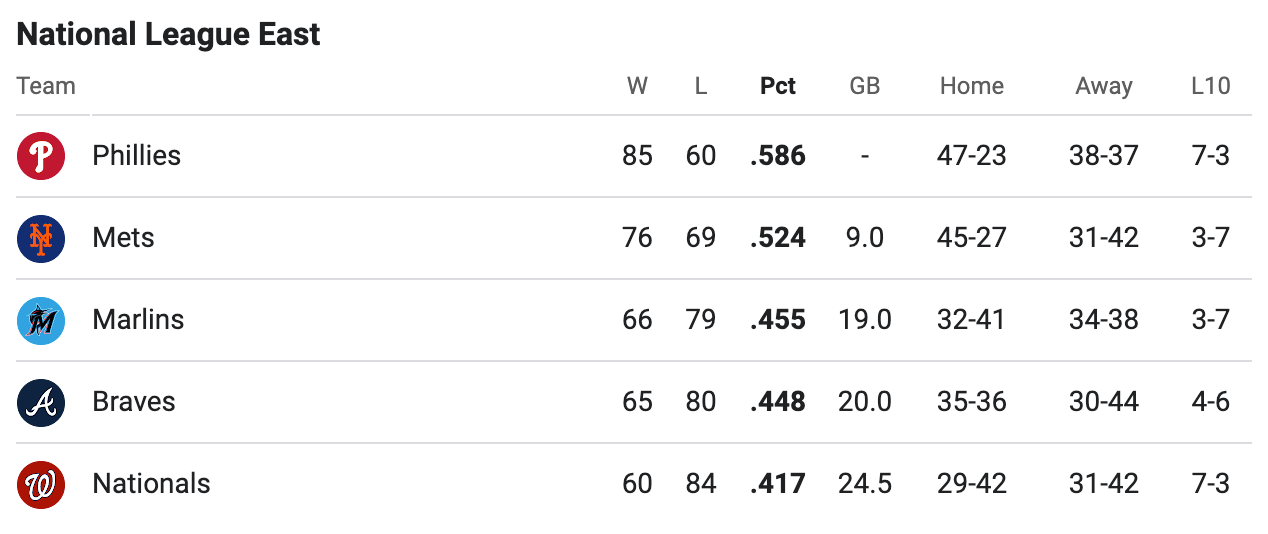

PHILLIES MAGIC NUMBERS 🪄

Postseason: 7

National League East: 9

First Round BYE: 14

LINKS 💣

GO BIRDS 🦅

THE LINKS 🔗

YOUR MORNING TIMELINE ☕️

THERE’S STILL TIME: PHANS OF PHILLY 🛫

Make sure you’re set for the upcoming NFL season and doing your part in turning every Eagles Away Game into a home game. No better way to travel than with Phans of Philly.

💥 POWERED BY THE LIBERTY LINE

The Liberty Line has FULL COVERAGE on all things Philadelphia Sports. Make sure you have the website bookmarked. 📑

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.